- 5 June 2017

- Posted by: Twissen

- Category: Tech

The Travel & Tourism industry is constantly influenced by the development of technologies and by the online travel booking sector evolution. Recently PhocusWright, in collaboration with Expedia Affiliate Network, published the report “2017 Phocus Forward: The Year Ahead in Digital Travel”, which analyses the impact of online bookings in the different sectors of the industry.

According to the report, in 2017 this industry will record a total value of 1182bn euros. Even if Europe and the USA are expected to be the most performing markets, the Asia – Pacific region is going to register the most interesting results, in particular in the online and mobile travel. This sector is in fact expected to grow from a value of 456bn euros in 2016 to a value of 504bn euros in 2017. It is foreseen that the growth will be particularly interesting in the emerging markets, such as Middle East (+26%), Asia – Pacific region (+17%), East Europe (+16%) and Latin America (+11%). In particular, it is projected that, by 2020, Asia – Pacific will represent 37% of the total sector of the online travel bookings.

The air travel sector is facing a period of contrasting results. In fact, the most important airlines are facing the competition of low cost airlines, which are offering lower fares, also thanks to the decrease of the fuel price. The report also underline that the air travel sector is the most influenced one by the demand for online booking. In Europe and in the United States this sector is almost full: for example, in the USA, 60% of bookings happens online, while in Asia – Pacific is expected to reach the half of them by 2020.

The introduction of Artificial Intelligence services, such as chatbots (chat + bot, abbreviation of robot), to support booking processes marked an important evolution in this sector. Skyscanner uses Skype’s technology, while Kayak and Hipmunk offer the opportunity to book via Facebook Messenger. However, the number of researches which have been converted into bookings is not satisfying yet, also due to the limited engagement of airlines. On the other hand, China Southern Airlines is registering relevant results after the introduction of a bot on the popular app WeChat, which allows the users to research flights also via vocal requests.

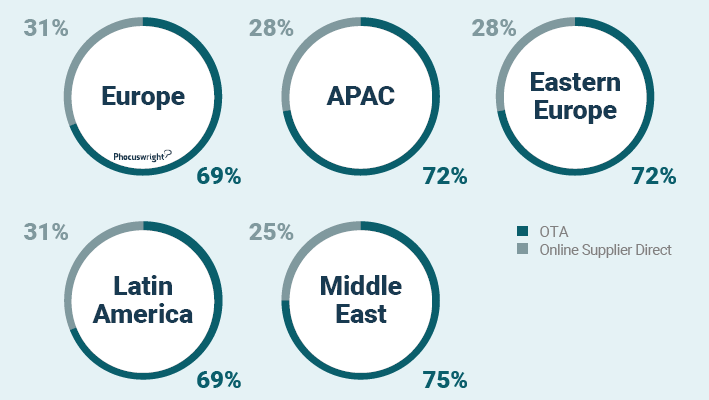

In the accommodation sector, taking as an example the United States, 60% of hotel bookings happens online. Moreover, at the end of 2016, 51% of total online gross bookings came from OTAs websites, passing for the first time the direct online suppliers portals. For this reason, hotel chains are trying to increase their direct booking, offering rates dedicated to affiliates in order to avoid rate parity clauses imposed by agreements with OTAs. In other markets, OTAs have been popular for a long time, and their predominance is also related to the growing use of mobile devices to research and book, in particular by the new generations such as Millennials, who are more likely to rely on online intermediators. This is also why hotel chains such as Marriott are designing and proposing products addressed to this target, such as Marriott Moxy and Radisson Red, following their preferences, namely the research for experience, sharing and contact with local culture.

Source: PhocusWright, 2017 Phocus Forward: The Year Ahead in Digital Travel

Notwithstanding, in 2016, 70% of global hotel transactions happened offline, namely via traditional travel agents or at hotels’ front desks.

To face the sharing economy, that in 2017 in the USA is expected to represent 18% of total accommodation gross bookings, some hotels are proposing in the short rentals market. For example, Accor Hotels, which is already owner of Square Break and Oasis Collections, in 2016 acquired the online rental platform onefinestay for 169mn dollars, and also announced the next acquisition of the American platform Travel Keys. OTAs did not stand still, an example is given by Expedia’s purchase of HomeAway.

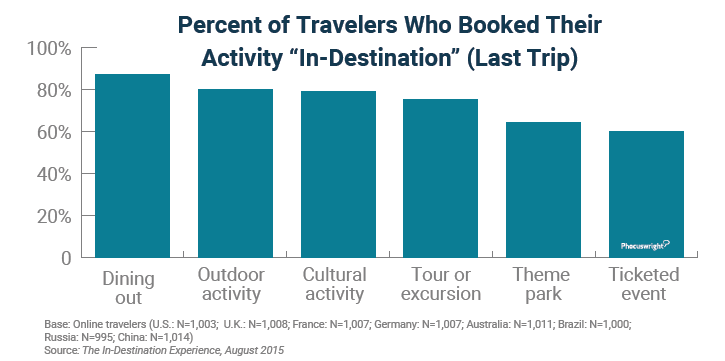

In the in-destination activities sector, due to the important fragmentation of the market and to the diversity of the existent activities, the online booking offer had a slower process. This has changed also thanks to a flourishing market of startups which allow to book in-destination activities in a simple way, often offering a software (SaaS, Software as a Service) to services providers.

Source: PhocusWright, 2017 Phocus Forward: The Year Ahead in Digital Travel

At Twissen we observed that the online booking sector is experiencing different trends depending on the type of offered service. There is room for business in online intermediation of in-destination activities, due to the growing demand for experiential tourism. In fact, the future of in-destination activities bookings seems to be mobile, as the volume of transactions of experiences during the journey is growing, thanks to the use of smartphones as the main tool.